Lunch & Investor's Analysis of Your Early-Stage Business

Item Number: 133

Time Left: CLOSED

Description

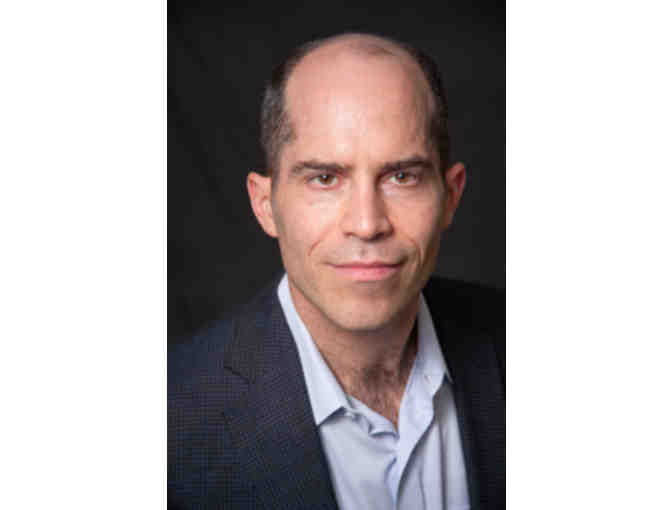

Are you thinking of raising venture capital to grow your early-stage business? David Teten, Managing Partner with HOF Capital, a technology venture capital firm, will critique your business plan and advise you on its investability and preliminary valuation over lunch in midtown Manhattan.

A Yale graduate and Harvard MBA (both with honors), David is Founder and Chairman Emeritus of Harvard Business School Alumni Angels of Greater New York, the largest angel investor group on the East Coast.

Before you present your business to the venture capital community, get frank feedback that will help you succeed. Please note: this investor critique is only appropriate if you're thinking of launching an investable business (e.g., a technology company), not the sort of business that does not normally raise outside capital (e.g., an independent consulting or law practice).

HOF Capital typically invests at Seed and Series A in North America and Western Europe, and opportunistically in later-stage companies. It has an unusually broad portfolio acceleration platform comprising 8 full-time staff; offices in New York (HQ) and London; and an international network. HOF is particularly interested in artificial intelligence, autonomous vehicles, computational biology, energy tech, fintech, brain-computer interfaces, robotics, cyber-security, and enterprise SaaS.

Special Instructions

By bidding on this item, you agree to be bound by the Limmud NY 2017 Online Auction Rules and Guidelines, which can be viewed here.