Scuttlebutt Barbershop - $30 Gift Certificate

Item Number: 406

Time Left: CLOSED

Description

Scuttlebutt Barbershop - $30 Gift Certificate

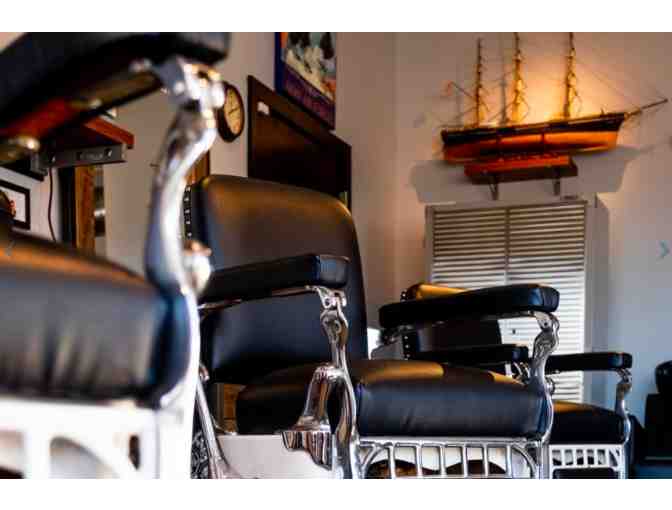

Scuttlebutt Barbershop is a traditional barbershop in Portsmouth, NH.

Established in 2015 by Nate Riggs, a Navy veteran, many ask where the name came from. The term “Scuttlebutt” is usually accompanied by a questioning facial expression and head tilt. To be expected! That is unless you were in a seagoing military service. The term was born from two naval terms. “Scuttle” means a hole in the ship’s hull causing it to sink while “butt” means the cask or hogshead from where a ship’s crew would drink water. Thus the navy slang “Scuttlebutt” was created and is still used today. Its meaning is equivalent to rumors or water cooler talk; something similar to what happens in a barbershop. So come on down to Scuttlebutt Barbershop to swap stories, talk about sports or whatever is on your mind!

Can be used in the Portsmouth Shop Only.

Special Instructions

Where applicable - the winning bidder is responsible for picking this item up from the BPC office in the 1791 building on campus between Wednesday March 6, 2019 and Friday March 8, 2019 or March 25, 2019 to April 12, 2019. If the item is not collected by April 13, 2019 then gift cards, tickets and gift certificates will be shipped to the winning bidder via regular mail, unless certified mail is specified by bidder prior to that date. If sent by certified mail, bidder is responsible for the shipping cost. All other items must be picked up.

To the Winning Bidder: Please keep the auction receipt for this item with your tax records to substantiate your contribution(s) to Berwick Academy. Federal tax law requires 501(c)(3) organizations, like Berwick Academy, to indicate if goods or services have been provided in exchange for your contribution(s). A good or service has been provided, therefore if the contribution(s) exceeds the estimated retail value of the item(s), you may be entitled to a tax deduction, within the limits otherwise prescribed in the Internal Revenue Code. Please consult your tax professional or the Internal Revenue Service for further guidance.